Indicators on Summitpath Llp You Should Know

Indicators on Summitpath Llp You Should Know

Blog Article

The Only Guide to Summitpath Llp

Table of Contents8 Simple Techniques For Summitpath LlpLittle Known Facts About Summitpath Llp.Summitpath Llp Can Be Fun For EveryoneOur Summitpath Llp IdeasThe 9-Second Trick For Summitpath Llp

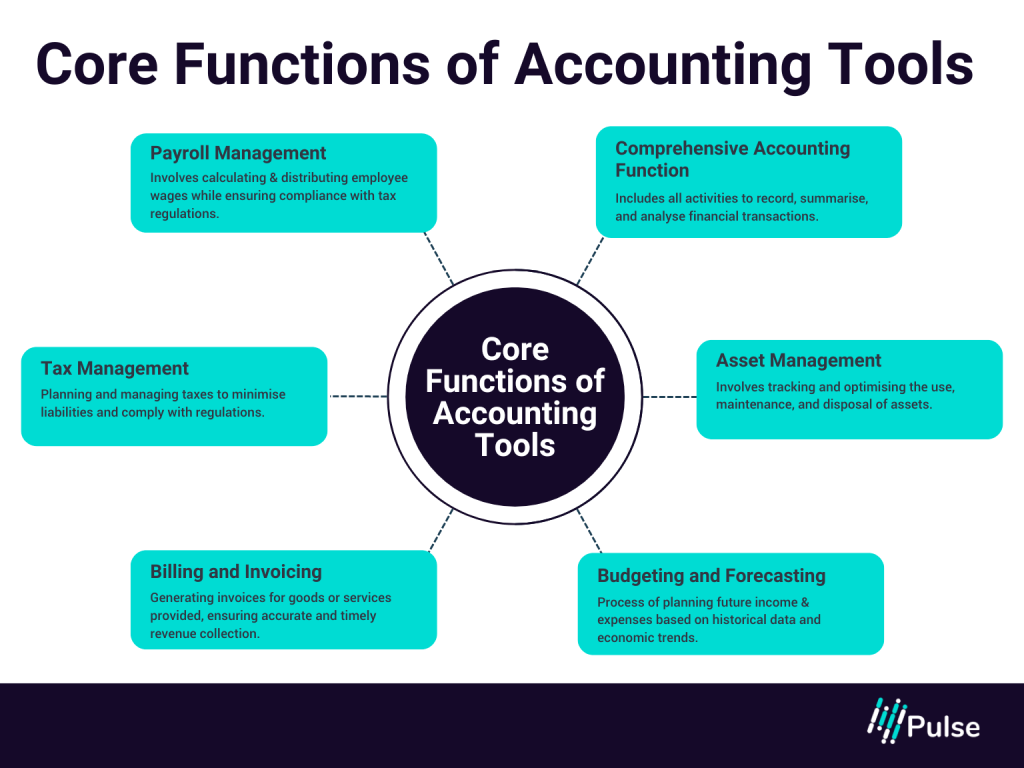

A monitoring accounting professional is a vital duty within a company, yet what is the duty and what are they expected to do in it? Working in the accountancy or financing department, management accountants are responsible for the preparation of management accounts and numerous various other reports whilst also managing general accountancy procedures and practices within the company - outsourcing bookkeeping.Compiling techniques that will minimize company expenses. Acquiring financing for tasks. Recommending on the financial ramifications of business decisions. Developing and managing economic systems and procedures and identifying possibilities to improve these. Managing earnings and expense within business and making sure that expenditure is inline with budget plans. Looking after accountancy professionals and assistance with generic book-keeping tasks.

Evaluating and taking care of danger within the organization. Administration accountants play a very vital function within an organisation. Key financial data and records created by administration accountants are made use of by senior management to make enlightened company decisions. The evaluation of business efficiency is a vital role in a monitoring accountant's job, this analysis is generated by taking a look at present monetary details and additionally non - economic information to establish the setting of the service.

Any service organisation with a financial department will certainly need an administration accounting professional, they are likewise regularly employed by monetary organizations. With experience, an administration accounting professional can expect solid job progression.

Summitpath Llp Can Be Fun For Everyone

Can see, examine and recommend on alternative sources of organization financing and different methods of raising money. Communicates and recommends what effect monetary decision production is carrying growths in policy, values and administration. Assesses and suggests on the appropriate methods to handle organization and organisational performance in connection with organization and money danger while communicating the influence effectively.

Uses numerous innovative techniques to apply technique and take care of change - outsourcing bookkeeping. The distinction in between both economic accounting and supervisory audit problems the intended customers of details. Supervisory accountants call for business acumen and their objective is to function as company companions, aiding business leaders to make better-informed decisions, while financial accountants intend to generate economic documents to supply to external parties

The Facts About Summitpath Llp Uncovered

An understanding of company is also essential for management accounting professionals, in addition to the ability to connect efficiently at all degrees to encourage and communicate with elderly members of staff. The duties of a management accounting professional should be carried out with a high level of organisational and calculated thinking abilities. The typical income for a chartered monitoring accounting professional in the UK is 51,229, an increase from a 40,000 ordinary made by management accountants without a chartership.

Giving mentorship and management to junior accountants, cultivating a culture of collaboration, growth, and functional excellence. Collaborating with cross-functional groups to develop spending plans, forecasts, and lasting monetary strategies. Remaining informed regarding changes in bookkeeping guidelines and finest techniques, applying updates to inner processes and documents. Essential: Bachelor's degree in accountancy, finance, or an associated field (master's liked). Certified public accountant or CMA accreditation.

Charitable paid time off (PTO) and company-observed vacations. Expert growth possibilities, consisting of compensation for CPA accreditation costs. Versatile job alternatives, consisting of crossbreed and remote schedules. Access to wellness programs and staff member help sources. To use, please send click over here your resume and a cover letter describing your certifications and interest in the elderly accounting professional duty. affordable accounting firm.

Summitpath Llp - Truths

We aspire to find a skilled elderly accountant prepared to add to our company's economic success. For queries concerning this setting or the application process, contact [Human resources get in touch with information] This job posting will end on [day] Craft each area of your task description to show your organization's special requirements, whether employing a senior accounting professional, corporate accountant, or one more specialist.

A strong accounting professional task account surpasses listing dutiesit clearly communicates the qualifications and expectations that align with your company's requirements. Separate in between essential qualifications and nice-to-have abilities to aid candidates determine their viability for the placement. Specify any kind of qualifications that are necessary, such as a CPA (Cpa) permit or CMA (Qualified Administration Accountant) classification.

The Buzz on Summitpath Llp

Adhere to these best practices to produce a work description that resonates with the ideal prospects and highlights the unique elements of the function. Bookkeeping roles can differ commonly depending upon seniority and expertise. Stay clear of ambiguity by describing particular tasks and areas of emphasis. For instance, "prepare regular monthly monetary declarations and oversee tax filings" is far more clear than "handle monetary documents."Mention vital areas, such as financial reporting, auditing, or pay-roll management, to bring in prospects whose skills match your demands.

Accounting professionals aid organizations make crucial economic choices and adjustments. Accounting professionals can be liable for tax obligation reporting and filing, resolving equilibrium sheets, helping with departmental and organizational spending plans, economic projecting, connecting searchings for with stakeholders, and extra.

Report this page